#Contribution per unit calculator mac#

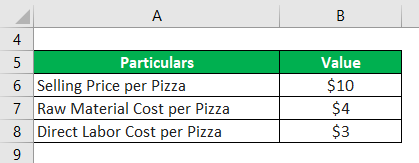

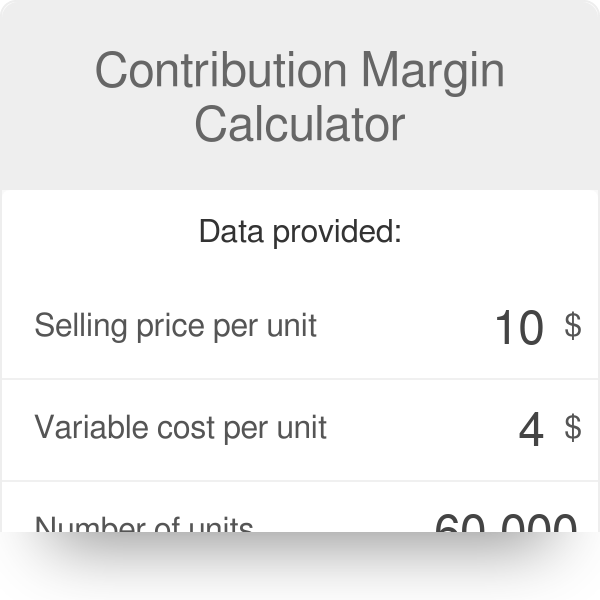

School University of South Africa Course Title FINANCE MAC 4861 Uploaded By BailiffSparrow1284. To calculate the required sales level, the targeted income is added to fixed costs, and the total is divided by the contribution margin ratio to determine required sales dollars, or the total is divided by contribution margin per unit to determine the required sales level in units. Boxes conforming to the Mullen Test standard are identified as 200# Test, 275# Test, etc. The contribution margin is computed as the selling price per unit, minus the variable cost per unit. As you can see, Casey has a CM of $150,000. Required: (a) Calculate the contribution margin per composite unit. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. Cant Post Photos To Tinder? The contribution margin can be stated on a gross or per-unit basis. Multiply the contribution margin per unit for each product by the number of sales, and then add the totals. The contribution margin can be stated on a gross or per-unit basis. The revenue is the price for which you're selling the product minus the variable costs, like labor and materials. To continue with the example, ABC International has calculated that it generates a contribution margin of $10 per unit, based HOA initial contribution of 300 then 52.52 per year per acre. In other words, it is also known as the Contribution margin per unit calculator. Example #2 Let us take the example of another pizza selling company to illustrate the alternate method of UCM computation. Our Products About us Contact us Call us +964 7723342222. S try to understand the contribution margin formula is calculated by su A company manufactures and sells blades that are used in riding lawnmowers. To calculate the CM, we simply deduct the variable cost per unit from the price per unit. Contribution per unit is the residual profit left on the sale of one unit, after all variable expenses have been subtracted from the related revenue.

Contribution Margin per Unit = $100 $65 Contribution Margin per Unit = $35 per unit Total Contribution Margin is calculated using the formula given below Contribution Margin = Net Sales Total Variable Expenses Contribution Margin = (No.

(5 marks) 3) How much would the company's operating income increase or decrease if. Of units sold) = 150*2500 Request additional information, schedule a showing, save to your property organizer.

0 kommentar(er)

0 kommentar(er)